Austin freelancers, we’re now down to less than four short weeks to get health coverage for 2018! You have until December 15th to enroll. Here’s a quick and easy guide to help you get covered.

Why should I get covered?

Health insurance is much more than an additional monthly expense. It is an investment in your future well-being and it gives you peace of mind to live your life. No matter what your health profile is, there are benefits for everyone who has health insurance. ACA-compliant health plans, in particular, offer essential health benefits, which help you stay healthy and spot issues before they become a problem. With free screenings, vaccines, labs, and annual checkups with your primary care doctor, you’ll ultimately save money and get sick less.

Of course, you never want to imagine an emergency medical situation, but it is the leading cause of debt in the U.S. In a worst case scenario, health insurance is on your side to keep you and your pocketbook protected.

Key terms to know before you start shopping:

*Note you can check out a full glossary here.

- Open Enrollment: period of time when individuals and families can enroll in health insurance. This year, Open Enrollment will run from November 1st through December 15th.

- Premium: fixed monthly fee you pay your insurer to keep your health insurance plan active.

- Deductible: dollar amount you pay out of pocket for covered services before your health insurer begins to share costs for care. Depending on the plan type, some benefits are offered “pre-deductible” and your insurer will share costs with you on day one for these benefits.

- Maximum Out of Pocket (“MOOP”): maximum dollar amount you’ll pay in a given year for care. Once you hit this number, the insurer pays 100% of covered in-network services.

- Copayments: fixed dollar amounts you’ll pay for covered services.

- Coinsurance: a percentage of the cost of a covered service that you owe, your insurer picks up the rest.

- Subsidies: see directly below!

Subsidies: do I qualify?

The Affordable Care Act (ACA), gave people at certain income levels the opportunity to receive subsidies for their health insurance. There’s been a lot of political noise lately about what’s happening with federal subsidies in 2018. However, for the individuals like you who are purchasing health insurance, nothing has changed for 2018. Depending on your income, you can still qualify for government subsidies during plan year 2018.

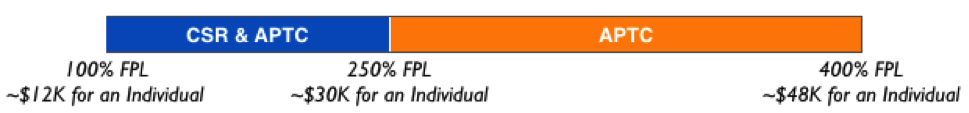

There are two types of subsides – the Advanced Premium Tax Credit (APTC) and Cost Sharing Reductions (CSR). Your estimated annual income, measured as a percentage relative to the “Federal Poverty Line (“FPL”), will determine your eligibility for both of these. The chart below outlines subsidy eligibility relative to income, but you can use healthcare.gov to determine exactly what you’ll pay based off income and family size for On Exchange plans.

APTC: Premium tax credits are calculated based off your income – the less you make, the larger your subsidy and vice versa. In the world of ACA subsidy eligibility, any consumer making between 100% and 400% of the Federal Poverty line (approx. between $12K and $48K) is eligible to receive government assistance on their premium payment for an On Exchange insurance plan. As a reminder, you can only receive subsidies if you buy an On Exchange plan.

CSR: If you make between approx. $12K and $30K you’ll also qualify for CSR subsidies (i.e. you get both APTC and CSR subsidies) available on “Silver” tier plans. These subsidies bring down the cost of deductibles, maximum out of pocket spend, and cost shares on your plan. Similar to the APTC calculations, the less you make the richer the subsidy benefit.

Note: even If you think you’ll make slightly more than 400% FPL, enroll “On Exchange”. You can (and should) update your income regularly, and, by doing so, you will be able to receive subsidies if your income drops below 400% FPL.

Where can I buy?

- Buying On Exchange: If you’re eligible for and want to use government subsidies to reduce monthly premium costs (and potentially deductibles, cost shares, etc), you must apply through healthcare.gov. (See the “Subsidy: Do I qualify?” section above.)

- Buying Off Exchange: If you are not subsidy eligible (i.e. you make more than roughly $48K as an individual, see below), then you can enroll in a plan off the federal exchange directly from the carrier. Without factoring in subsidies, some plans off the exchange may be cheaper than the On Exchange plans.

How should I pick a plan?

After you know where to buy based off your income/subsidies (i.e. On vs. Off Exchange), you should spend some time evaluating each available plan option. Plans should be evaluated on a case by case basis – the best plan for a young, relatively healthy 28 year old may be different than the best plan for a 60 year old who is taking a handful of specialty drugs. That said, here are a few things to look at when evaluating the plan that meets your needs.

- Review your current list of doctors and see which plans they take. Make a list of your current doctors and check the carrier’s provider search tools (or call their offices) to see if they’re “in network”. Be honest with yourself: which doctors do you love and which can you lose? If you see a doctor you can’t live without, you should select an insurance plan they accept, otherwise you’ll be responsible for the full cost of your care if you continue to see them.

- Calculate your health care costs. Grab a calculator and tally up your health care costs for the past year. How much did you spend on doctor’s visits, diagnostic lab work, drugs, etc? This information, in addition to checking monthly premiums and deductibles across plans, can help you figure out which plan will be the most cost effective.

- Explore Plan Types. You’ll see two different types of plans in Austin: HMOs and EPOs.

- HMO (Health Maintenance Organization) plans require you to select a primary care doctor, who will serve as the gatekeeper for all additional care you receive. Referrals are required before you get care from a specialist, lab, or medical facility, even for preventive screenings such as colonoscopies and mammograms. There are two exceptions: Emergencies don’t require a referral with this plan type, and women don’t require referrals to see their OB-GYN.

- EPO (Exclusive Provider Organization) plans combine the flexibility of a PPO with the cost savings of an HMO. With this plan type, you don’t need to see a primary care doctor or obtain referrals before getting care. The catch is that you must stay within the EPO network in order for your care to be covered. Out-of-network care may be covered in emergencies, but, for other non-emergency services, you’ll be responsible for the cost.

- Choose a metal tier. Health plans are broken into coverage levels called metal tiers. In Austin, you’ll find plans at the Catastrophic, Bronze, Silver, and Gold tiers. Each tier has the same set of benefits but different levels of coverage. When assessing them, you’ll want to pay attention to their monthly premium, deductible, copayments/coinsurance amounts, and benefits for services you routinely receive. As a general rule, the richer metallic tiers (e.g. Silver, Gold) feature more expensive premiums but offer superior coverage. So you’ll pay more in monthly premium for a Gold plan vs. a Bronze, but the deductible and cost shares for health care services will likely be less expensive.

- Keep an Eye out for Plan Perks. Some health insurance plans include additional perks for when you’re healthy or under the weather. Depending on your insurance provider, these include free and unlimited telemedicine (e.g. Oscar’s Doctor on Call) and step/fitness rewards programs.

Note: If figuring all that out sounds overwhelming, a health insurance broker can help with this part.

What are my plan options?

With Oscar’s entry into the market this Open Enrollment, Austin residents will have a total of four On Exchange options and five options available off the exchange. See below chart for a snapshot of the players and their respective plan offerings:

| Exchange Availability | Price | Plan Type | Network | Metallic Tiers* | |

| Oscar | On / Off Exchange | $ | EPO | Provider Search | C, B, S, G |

| Vista360Health | Off Exchange only | $$ | HMO | Provider Search | B, S, G |

| Sendero | On / Off Exchange | $$ | HMO | Provider Search | B, S, G |

| Ambetter | On / Off Exchange | $$$ | EPO | Provider Search | B, S, G |

| BCBSTX | On / Off Exchange | $$$$ | HMO | Provider Search | C, B, S, G |

*Note: “C”, “B”, “S’, and “G” stand for Catastrophic, Bronze, Silver, and Gold respectively.

OK, I’m ready to buy a plan. Where should I go?

There are four primary ways to get support and enroll in a health insurance plan:

- Healthcare.gov: On Exchange plans are available through healthcare.gov. Based on your financial information, these marketplaces will help determine if you’re eligible for government subsidies, which may significantly lower the cost of your monthly premium and other health care expenses. The exchange can also help determine if you’re eligible for government-assisted insurance like Medicaid or Medicare.

- Insurance Brokers: On and Off Exchange plans can be purchased directly through a health insurance broker. There are two core types of brokers:

- Traditional Broker: Individuals that can provide an overview of available plan options for a consumer and make plan recommendations based off the consumer’s situation. Carriers work with brokers across Austin to help distribute plans to both on and Off Exchange consumers. If you’d like an introduction to a broker, feel free to reach out and I’ll connect you with a few.

- Web Broker: Web based entities that operate marketplace style platforms for online quoting and enrollment. Generally, these platforms have much cleaner interfaces than the exchange, and some have robust call centers to help those that would like to speak to a person over the phone. A good example is Austin-based KindHealth, they sell all available plans across Austin on their platform.

- Local Navigators: Primary objective is to educate consumers about health plans and provide guidance toward making a wise buying decision (vs. a definitive recommendation). They can provide resources for those looking for more information on plans available on the exchanges. If you’re interested in working with a Navigator, Foundation Communities is best in class.

- Insurance Carriers: Call the carrier of your choice to enroll over the phone, or, if you’re off exchange, visit their website to get a quote and enroll in a plan (e.g. if interested in an Oscar plan, you can run a quote and enroll here).

Regardless of the plan you select or how you buy, it’s important that you get covered – there are a handful of great options for Austin consumers in 2018. If you still have questions, feel free to check out Oscar’s FAQ or talk to a broker or navigator.

- Health Insurance for Freelancers: Getting Covered in 2018 - November 20, 2017